Paperchase’s hospitality accountants deliver valuable, detailed reporting, on a weekly and monthly basis to guide operational efficiency, and guide operations to achieve key performance metric goals like COGS. COGS, or Cost of Goods Sold is your purchases and inventory against your revenue for the same period. Paperchase helps restaurants hit COGS benchmarks for their category. We tailor our analysis to each operation, but generally, we like to see fine dining restaurants hitting a target, and casual restaurants achieving between 30-35%. We’ll break down COGS benchmarks by restaurant category and examine four crucial areas for achieving operational efficiency by lowering your COGS.

Inventory

The most important part of your COGS is regular inventory control. If this area is out of balance, it will affect your entire report. Conduct physical counts at least on closing days of a period. To optimize efficiency, consider the 80/20 rule – focus on counting 20% of your inventory with the 80%, as this will give you a good overall picture and discourage theft and overuse. Regularly analyzing variances compared to prior periods helps you identify trends in what’s selling well and what’s not, especially for beverages. Acting on slow-moving items is key. Move older stock to improve cash flow and Cost of Goods Sold (COGS). Use these ingredients in daily specials or recommend wine pairings to entice customers and reduce waste.

Internal Controls

To minimize waste and ensure you have what you need, plan your purchases by considering upcoming weather, customer volume (covers), and events. This helps avoid over or under-buying. Additionally, categorize your purchases accurately to streamline accounting and reduce errors. Paperchase’s accountants can also assist you in claiming any product yield credits, maximizing your return on investment.

Recipe Costing

Effective recipe costing requires meticulous attention to detail. Every ingredient, from garnishes to batched sauces, needs to be factored in to ensure an accurate cost per dish. Following the standardized recipe after costing is crucial, as any deviation can lead to accumulating variances and impact profitability. To stay ahead of these fluctuations, regularly update recipe costs for your best-selling dishes, especially quarterly. Prioritize re-costing the most expensive items to maintain control over your bottom line.

Menu Price

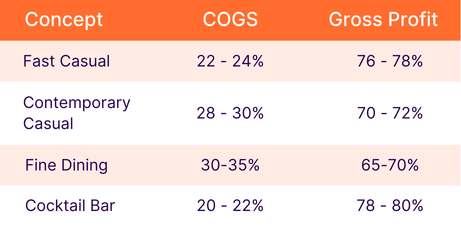

Setting profitable menu prices requires a two-pronged approach. First, consider your desired gross profit margin (industry benchmarks can be helpful – for instance, fast-casual restaurants typically aim for 76-78% gross profit after accounting for Cost of Goods Sold or COGS of 22-24%). Then, work backwards to determine the menu price that will achieve this target profit.

This ensures you factor in all costs while leaving room for profitability. Remember, menu pricing is an ongoing process. Regularly monitor ingredient costs and adjust prices accordingly to maintain your desired margins. Finally, embrace seasonal ingredients! They can not only reduce costs but also attract customers with exciting new specials, further boosting your bottom line.

Operating Expenses

Working with a hospitality finance expert to analyze your operating expenses is crucial. Things like POS (point of sale) systems fall under this category. The most expensive operating expenses are your rent and insurance. Maintain a healthy and communicative relationship with your landlord to ensure rent is paid on time and you do not have to pay late fees. Restaurants are chaotic, It is important to keep track of your operating expenses so you have breathing room to pay for things like unexpected repairs and maintenance.

Conclusion

At the end of the day, numbers can be overwhelming, and a P&L report is the last thing a busy manager wants to see at the end of the day. Paperchase’s team of specialized hospitality accountants work with restaurants of all different types to give you a service that is reliable, helpful, and easy to understand. Streamlined monitoring of your KPIs and COGS is the first step towards maintaining the health of your business, and Paperchase is here to help.

Looking for a more detailed analysis? Check out our Restaurant Finance 101 Sessions HERE. These educational sessions are free to the public and aimed at giving managers, bartenders, and line cooks the tools they need to become the successful restauranteurs of tomorrow. Our first session gives a detailed look at KPIs and how to read a P&L and the second class is a crash course in COGS. You don’t want to miss this incredible opportunity to advance your career.

Share this article with your community